Today Disney is hosting an investor day at ESPN. The company will be showcasing presentations from various executives to large investors as well as investment firms. Traditionally, Disney has used these events to break news and discuss the future of the company. Follow us as we report on the entire day.

1225: Listening to Radio Disney hits as I wait for the presentation to begin. “Replay” by Zendaya to be specific

1233: Lowell Singer, the head of Investor Relations, starts the meeting by noting that the meeting is taking place in ESPN’s new NFL studio at the new Digital Center in Bristol, CT

1238: Breaking sports news during the conference, Duke freshman Jabari Parker will enter the NBA draft, He averaged 19.1 points per game in his only season with the Blue Devils. If I remember correctly, Lowell Singer is a Blue Devils fan.

1242: Bob Iger takes the stage. For the record he is a Clippers, Knicks, Yankees, and Packers fan

1243: Bob compares ESPN’s franchises such as Pardon the Interruption to other company franchises such as Toy Story and Star Wars

1247: Bob Iger introduces the head of ESPN, John Skipper. Skipper did not start with Disney at the worldwide leader in sports. He actually started with Disney Publishing.

1252: Skipper says that ESPN’s priorities are rights portfolio, affiliate agreement, strategic investment, embracing new technologies and platforms.

1257: Artie Bulgrin (Mets, Jets, Knicks) Senior Vice President Global Research + Analytics for ESPN takes the stage. He started his Disney career with ABC.

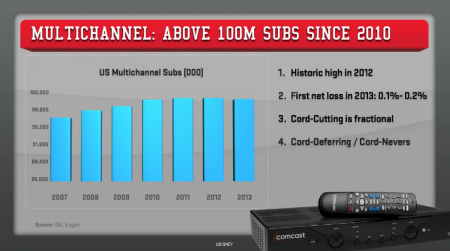

1259: Bulgrin address the cord-cutting phenomenon which he underplays. He also says that sports fans are less likely to cut the cord.

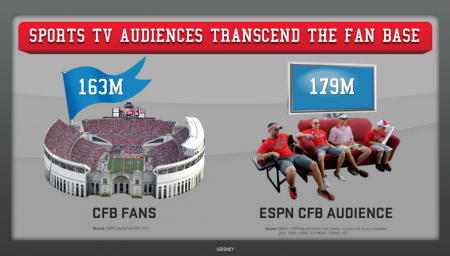

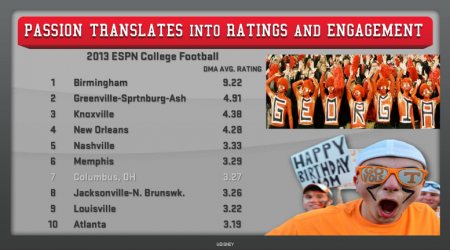

102: Bulgrin shows that sports reach viewers beyond those that consider them sports fans. For example, there are 163 million College Football Fans in the United States, but 179 million people watched ESPN’s College Football programming.

102: Bulgrin shows that sports reach viewers beyond those that consider them sports fans. For example, there are 163 million College Football Fans in the United States, but 179 million people watched ESPN’s College Football programming.

105: ESPN shows some of their most successful television ads including this one to promote their upcoming coverage of the World Cup in Brazil.

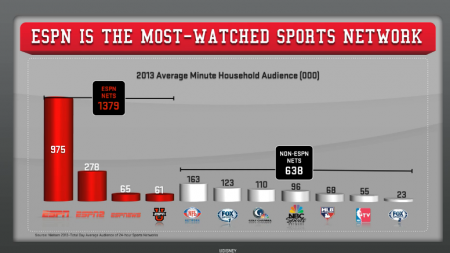

108: The audience of ESPN networks more than doubles the audience of all other sports networks combined.

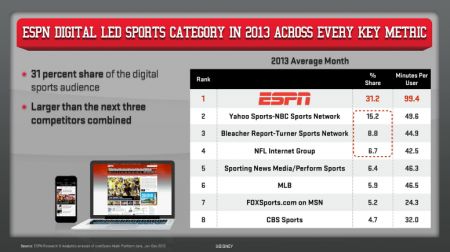

111: The conversation moves from television to digital media. ESPN Digital has led the sports category with 31 percent share of the audience. This is larger than the next three competitors combined. They also had an impressive minutes per user with 99.4 minutes spent per user in an average month.

119: Bulgrin ends his comments with these points. He also mentions that several people have named their kids after ESPN, but no one has named their children Fox Sports 1.

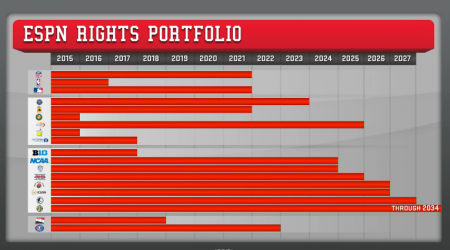

124: John Skipper returns to talk about content. He shares the sports rights ESPN has. There has been much competition in this space as of late with ESPN losing the rights to NASCAR and the World Cup.

124: John Skipper returns to talk about content. He shares the sports rights ESPN has. There has been much competition in this space as of late with ESPN losing the rights to NASCAR and the World Cup.

127: When ESPN negotiates rights, they obtain them in a cross-platform way with the only exception being that you can’t watch Monday Night Football on your cellphone, but you can watch it on your computer.

130: ESPN has also found success with the content they create. An example College Game Day beats Fox Sports 1’s College Football morning show 28 to 1.

140: Skipper concludes his remarks with this clip where SC Featured revisits the story of Dartanyon Crockett, Leroy Sutton and former ESPN producer Lisa Fenn, who formed an unlikely family and altered the course of each other’s lives.

1:45 ESPN personality Rece Davis takes the stage. Instead of sharing his favorite sports teams, he shared his favorite Wall Street firm.

1:58 Rece then spends some time discussing the man he credits with making College Game Day much watch television each Saturday morning during the College Football season, Lee Corso

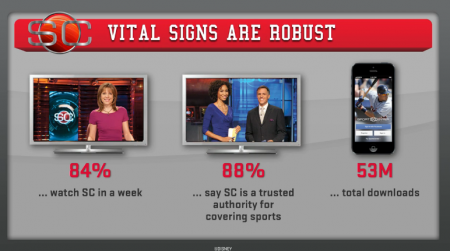

203: Hannah Storm now takes the stage to discuss SportsCenter. In a survey of sports fans, 84% watch SportsCenter in a week. 88% say SportsCenter is a trusted authority for covering sports. There have also been 53 million of the SportsCenter mobile app. If SportsCenter was a standalone network, it would be the 5th ranked cable network.

209: Hannah also shares a tour of the new SportsCenter set which will be premiering next month.

217: ESPN.com’s heaviest traffic days are the first two days of the NCAA Tournament and NFL Sunday. Both of which, ESPN does not have the rights to.

219: ESPN.com’s mobile usage is bigger than desktop usage (51% vs 49%)

226: They are now talking about ESPN’s new Digital Center 2 which will house studios, edit bays, and control rooms. It will also feature enough fiber optic cable to stretch from Bristol, CT to Walt Disney World

229: Break time as everyone gets a tour of ESPN’s Digital Centers. Presentations will resume in about an hour.

232: Bloomberg reports on Disney’s Investor Day at ESPN.

351: The presentations resume with John Skipper introducing UConn’s women’s basketball coach Geno Auriemma. He has one more championship than Pat Summit and one less than UCLA’s John Wooden.

357: Sean Bratches, a 27 year ESPN veteran comes to talk about distribution revenue, which is ESPN’s largest source of revenue thanks to cable operators paying a significant amount to carry ESPN.

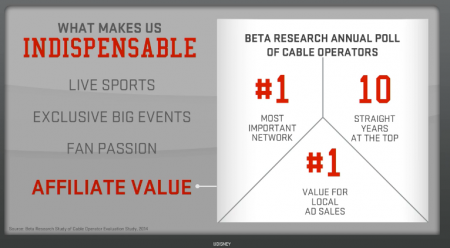

400: ESPN is able to get more money from the cable companies due to the importance of watching sports live, their exclusive big events, fan’s passion for the networks, and the affiliate value they provide. More people say they would switch TV providers if ESPN was not available on their current provider. This gives ESPN a lot of power in negotiations.

404: ESPN is touting their recent deal with Dish which will include ESPN on a new personal video service. This means that ESPN will be available to households that don’t pay for traditional television service and receive select networks through the internet.

407: The conversation now turns to ad sales. ESPN does well with ad rates as they are able to attract a large audience with DVR-proof audience. 96% of ESPN viewing is live.

415: As companies know that ESPN knows how interact with sports fans they have asked ESPN to develop ad campaigns for them. This Levi’s commercial is an example of this.

423: Russell Wolff Executive Vice President and Managing Director of ESPN International takes the stage. ESPN has 24 networks outside of the United States as well as websites, apps, and other services. They have tried to focus on countries where there is growth potential. An example of this is ESPN’s purchase of the Cricinfo.com website which covers cricket worldwide. 30 million United States citizens identify themselves as cricket fans as the sport grows in the United States.

435: 6 different local versions of SportsCenter are produced for Latin America

446: The last business presentation is on the SEC Network which is launching August 14.

451: Nine out of ten top College Football markets are in SEC Country. Those pesky The Ohio State Buckeyes break into the list.

455: The SEC Network will have a triple header every Saturday. They are launching the season with a special Thursday night double header. Brent Musberger and Jesse Palmer will call the headlining game each week. The morning show, SEC Nation will be hosted by Paul Finebaum and Tim Tebow. Paul and Tim and present to talk about the SEC Network.

500: Paul Finebaum wrote a book about the SEC. My Conference Can Beat Your Conference: Why the SEC Still Rules College Football. It will be published near the launch of the SEC Network.

505: ESPN is doubling the SEC Storied franchise. These are films made by the ESPN Films division of the company. To give an idea of the stories they will tell, they shared the trailer for the recent SEC Storied film The Book of Manning”

511: Before Disney CFO Jay Rasulo comes to the stage, they share some This is SportsCenter ads, including one featuring Jay Rasulo. That one isn’t posted online, but here is a less interesting one.

514: Jay Rasulo says that due to long-term affiliate deals and most cable operator agreements in place, they are able to predict the growth of the cable business. They expect growth in the high-single digits. Note: Disney does not break-out ESPN so these figures are for Disney’s entire cable business.

515: Jay Rasulo said that due to their accounting calendar, Fiscal 2015 will have a 53rd week. As if 2015 was not special enough already.

522: Q&A Time: First question is about the Dish personal service offering and if they are concerned about negative effect on the main service. They do not believe that they are concerned about that and it will become clearer as Dish announces more details about the service.

524: Second question is about growth opportunities with the SEC Network. Disney expects the SEC Network to get more carriage by cable companies as they get closer to launch. Regarding the NBA, they will try and negotiate an extension of the deal with fiscal discipline at top of mind.

526: The next question is about how to gauge non-television viewership. ESPN has created a system as Nielsen was not tracking non-linear viewing.

527: Next is a question about the Big 10 contract and how would expansion beyond the 14 teams that comprise the conference effect negotiations. ESPN does not believe we will see major conference movement and ESPN prefers it that way.

529: Next question is regarding the future of OTT (over-the-top) services. ESPN replies that they will continue experimenting with new business models.

532: An investor asked if the ad prices of live sports is outpacing the ad rates of entertainment programming. ESPN gave a non-answer.

534: The next question was about the impact of the new College Football Playoffs would have on the network. ESPN feels that the ratings impact will be profound and that the championship game will be the second most important day on the sports calendar.

539: Next was asked about the cost of the new Digital Center. The analyst predicted it cost $300 million, but Disney would not comment on that prediction. The center will open May 26 with SportsCenter with the NFL studio premiering in September.

542: An investor asked about growth in ESPN International. ESPN will continue to grow their business in Latin America. Outside of Latin America, they believe growth will come from digital news and information. For example, they used to have the 18th ranked soccer site in the world and they have grown to number 4.

545: Last question. An investor asks about the advantages and disadvantages of being a part of Disney. John Skipper said he was highly satisfied with being a part of Disney as he was with Disney before they purchased ESPN. He says Disney has allowed for an incredible level of support and investment. Skipper says he feels ESPN is a very comfortable fit within Disney.

548: That concludes the conference. The next big financial event for the company will be the second quarter earnings release on May 6.