Apple Card in the Disney Parks: How to Earn 2% Cash Back During Your Next Parks Visit

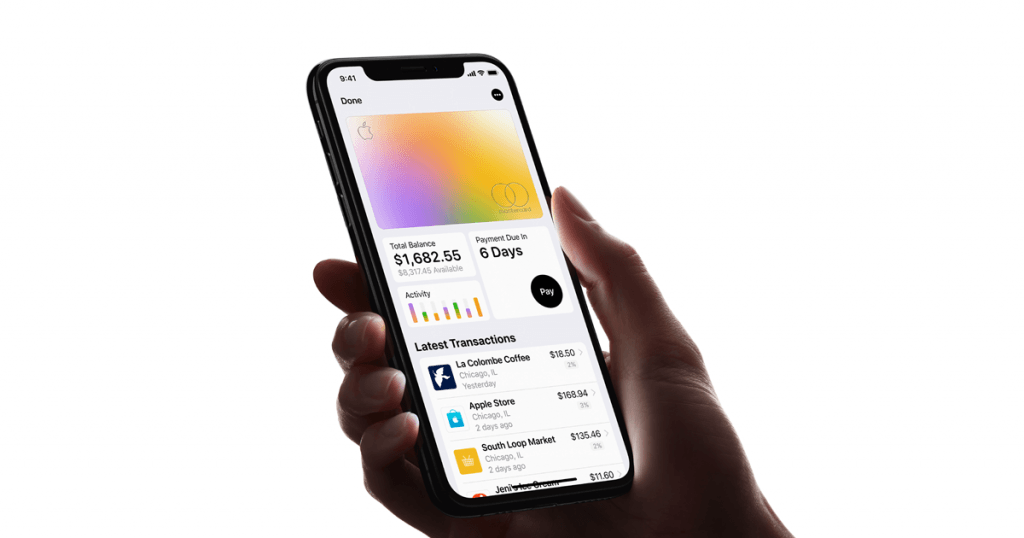

Months after it was first announced and following an invitation-only rollout period, the Apple Card is now accepting applications. The unique credit card offering is the product of a partnership between the Cupertino company and Goldman Sachs — although the former has boasted that it’s “Created by Apple, Not a Bank.” From its simple and speedy application process to its Daily Cash payouts and aesthetically pleasing titanium card design, there’s a lot to like about the Apple Card. However, if you’re on the fence applying for it, here’s something to consider: it may help you earn cashback on your next Disney Parks trip.

The Apple Card features three cashback categories: 3% back on Apple purchases, 2% back on transaction made using Apple Pay, and 1% back on everything else. As it turns out, that middle category is key here. Since many locations at Walt Disney World and the Disneyland Resort accept Apple Pay, cardholders can earn 2% back on their Disney Parks purchases. I actually put this to the test on a recent visit, earning $2 back on my $100 gift card purchase on Batuu. Plus, that cashback was added to my Daily Cash balance the next day, meaning I could have turned around and spent it on a snack in the park (although finding a Disney treat for under $2 would surely be a trick).

Surprisingly, the 2% you can get from using your Apple Card via Apple Pay at Disney bests the 1% the standard Disney Visa from Chase earns you. Meanwhile, the Disney Premier Visa does offer 2% back at “most Disney locations,” although that card carries a $49 annual fee (Apple Card has no annual fee). Of course, the Disney Visa does include some other perks that might make it worth having with you at the Disney Parks even if you don’t use it for every transaction of your trip.

One downside of the Apple Card is that the places where you’ll likely be spending the most at the Disney Parks are also where using Apple Pay might prove the most difficult. For example, I don’t imagine you can hand your phone to your waiter at a table service restaurant. Additionally, at Walt Disney World, linking your Apple Card to your MagicBand won’t give you the same 2% benefit as you won’t directly be using Apple Pay.

As a personal finance blogger, I do feel compelled to note that these credit card rewards are only a good deal if you are paying off your balance in full each month. Otherwise, the interest that the Apple Card, the Disney Visas, and others charge will completely erase any cashback benefits you may earn. Therefore, if having a credit card will only enable your temptation to spend, it’s best to keep away. Also, at this time, the Apple Card is only available to iPhone users with an iPhone 6 or later (and is subject to credit approval, of course).

With all that said, hopefully you can use the new Apple Card to your advantage and earn yourself some significant cashback on your next Disney vacation.

P.S. — This post was in no way sponsored by Apple (or anyone, for that matter).