Nelson Peltz Gets Support From Former Marvel Executive Ike Perlmutter in Fight for Disney Board Seat

Shareholder Nelson Peltz is once again attempting to gather more seats on Disney’s board, and he now has an ally in former Marvel executive Ike Perlmutter, according to Yahoo Finance.

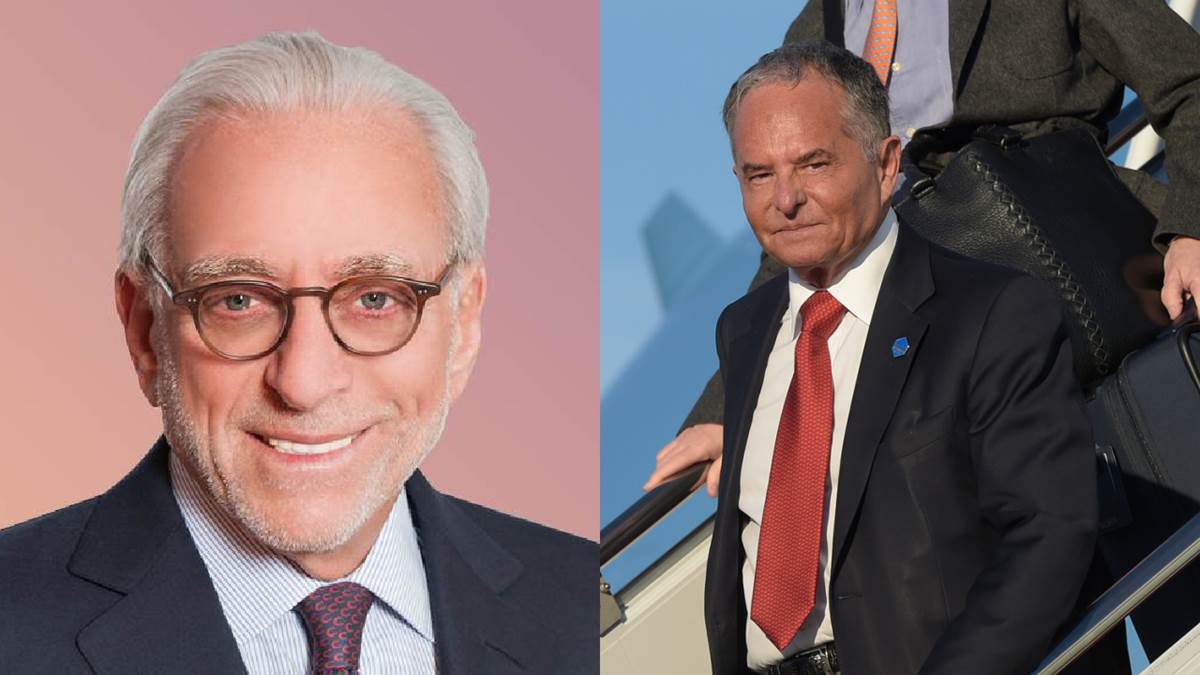

Left: Nelson Peltz | Right: Ike Perlmutter

What’s Happening:

- Former Marvel executive Ike Perlmutter has entrusted his stake in the company to Peltz, who recently launched a renewed attack on the media giant.

- Perlmutter was ousted from his position as chairman of Marvel Entertainment amid the company's mass layoffs in March and remains one of the company's biggest independent shareholders.

- Peltz’s investor’s Trian Fund Management, now one of Disney’s largest investors with a stake valued at upward of $2.5 billion, is expected to request multiple seats—including one for Peltz.

- In January, Peltz started a similar proxy fight with Disney, trying to get a seat on the board.

- At the time, the firm said it owned about 9.4 million shares valued at roughly $900 million.

- In a press release at the time, Trian Group said they believe they "can help Disney restore the magic and reclaim its position as a best-in-class company that delivers highly attractive returns for shareholders."

- Peltz withdrew his nomination in February after Disney unveiled a broad reorganization and cost-cutting plan that sent the stock up briefly.

- Peltz’s recent move comes as Disney’s stock recently hit its lowest point since February 2014, falling to an intra-trading day 52-week low of $78.73 on October 4th.

- Trian has built up its stake in recent months to more than 30 million shares, a significant jump from the roughly 6.4 million shares it held at the end of the second quarter.

What They’re Saying:

- Ike Perlmutter: "As someone with a large economic interest in Disney’s success, I can no longer watch the business underachieve its great potential. I urge Disney’s board to immediately welcome one or more Trian board candidates, including Trian’s CEO and Founding Partner, Nelson Peltz, into the boardroom. I believe Nelson and Trian can help Disney’s leadership better navigate the company’s challenges and opportunities."